A fresh, new year always brings up resolutions. These hopes and dreams usually surround health, love and money (and follow with many questions).

Some of the money questions you might be asking are:

Do you know where your money is going and are you investing it wisely? Are you in need of more financial education for 2018? How exactly does your 401(k) work?

With a focus on employee benefit plan audits, our team wanted to get millennials’ take on their 401(k) plans. We asked them questions around their company’s policies and how they are saving for retirement.

We had over 100 young professionals responding from Houston, Texas, Los Angeles, California, Milwaukee, Wisconsin, Washington, D.C. and everywhere in between. Their answers may shock you!

Do you know when you are able to begin participating in your company’s 401(k) plan?

Off to a great start! The majority of our participants (94%) knew when they were able to begin their 401(k) plan journey with their new company as opposed to only 6% of respondents who did not.

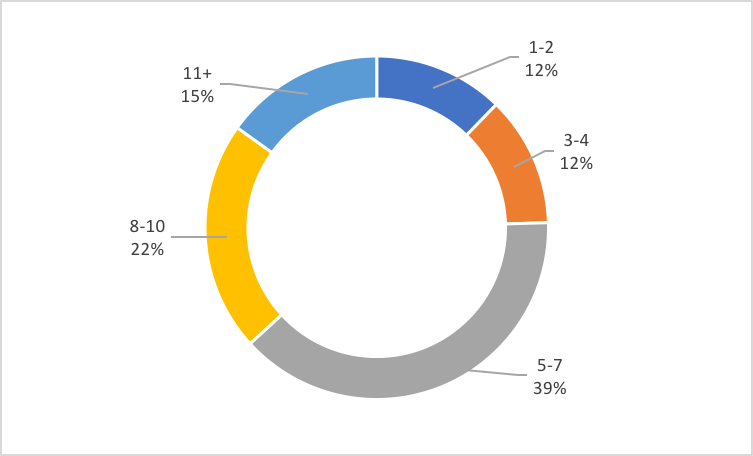

I contribute ___% to my 401(k) plan per paycheck.

That’s the big question, right? Our participants were all over the board with these answers. Although millennials are perceived as non-savers, all of our survey respondents were actively saving at some level and 37% were contributing at least 8% of their compensation to their 401(k) plan. Keep up the good work millennials!

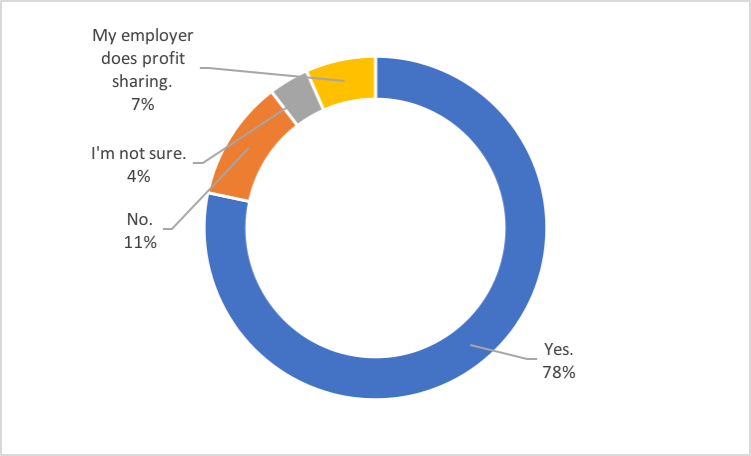

Does your employer make company contributions to your plan?

An overwhelming majority (85%) of participants stated that their employers supported their future financial success either through employer matching contributions or profit sharing contributions. Considering that employers are often not required to match contributions, especially in a down economy, the respondents in our survey are very supported in their savings journey. Most employers are well aware that providing a company match boosts plan enrollment and employee morale.

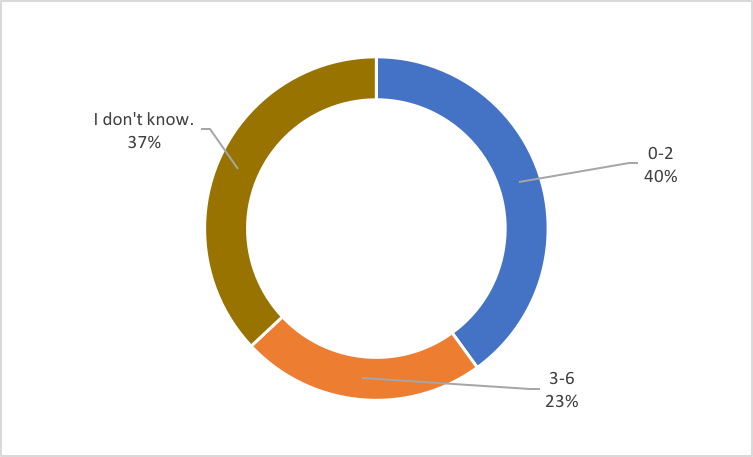

How many years does it take to become fully vested with your employer?

Although participants in our survey were well aware of their company’s contributions, 37% had no idea how long it would take to vest in those contributions. However, 40% of them reported they are either immediately vested or will be fully vested within 2 years.

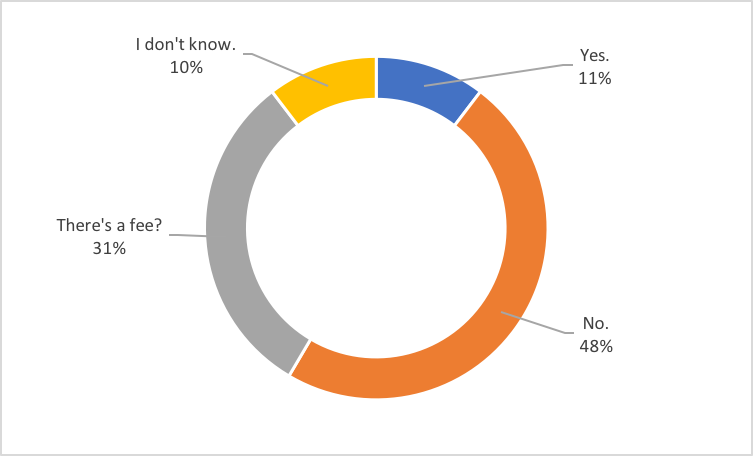

Do you know how much of your 401(k) savings is being used to pay for plan related fees?

Oh, there’s a fee for administering my 401(k) plan? Yes! Astonishingly, 89% of our responders lacked a proper understanding of plan fees. With employers under increasing scrutiny from the Department of Labor and the IRS, it is imperative that plan sponsors continue to educate themselves and participants about the plan fees.

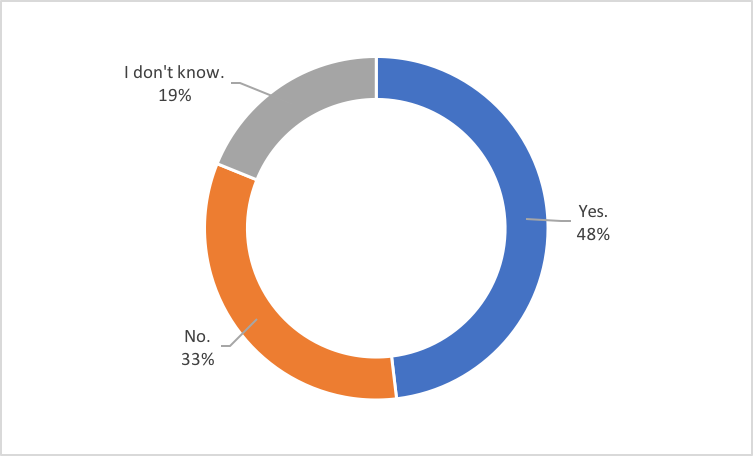

Does your company offer 401(k) education meetings?

With more than 50% of our respondents claiming either no 401(k) education or not knowing, employers should consider more effective ways to communicate current plan meetings, tools and general financial health resources. Plan providers have realized the importance of offering enhanced online participant education that is customized and easy to understand. Schedule time with your provider to see how they can help you enhance your current offerings and communications.