We file our individual tax returns every April 15, but do you know how your income tax is calculated? Understanding the marginal tax rates applied to your taxable income is essential for effective tax planning and informed financial decisions. Let us break it down!

What is Income Tax?

Income tax is a tax imposed on an individual’s income throughout the year. Most people pay income taxes on the wages they earn from their job. However, there are other types of income including, but not limited to, capital gains, interest and dividends, self-employment income, Social Security benefits, gambling winnings and unemployment benefits.

For a full list of taxable income types, visit the IRS website: Taxable income | Internal Revenue Service

How is Income Tax Used?

The average person pays their portion of tax through withholdings from their job throughout the year, while others make quarterly estimated payments. If you are like me, you’ve probably wondered at some point: “Where do my tax dollars actually go?”

Income taxes fund a wide range of federal government services and programs, including:

- Health insurance

- Social Security

- Defense

- Interest on debt

- Benefits for veterans

- Economic security programs

- Education

- Other government spending

What Are Marginal Tax Rates?

Unlike the corporate flat tax rate of 21%, your entire taxable income is not taxed at a single rate. In the U.S., income tax is calculated using a progressive system of marginal rates and tax brackets. This means taxable income is divided into sections (or “brackets”) and each section is taxed at a different percentage.

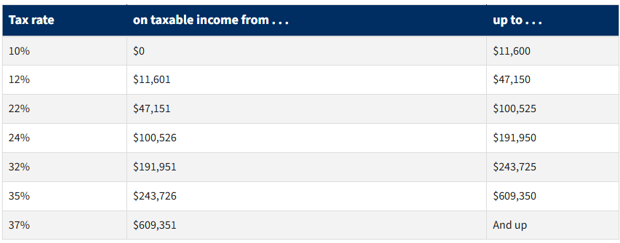

There are seven tax brackets, with rates ranging from 10% to 37%. As your income increases and you move into a higher tax bracket, only the portion of income above that bracket’s threshold is taxed at the higher rate.

Here is the tax bracket breakdown for single filers in 2025:

For example:

- If you have $40,000 of taxable income as a single filer, the first $11,925 is taxed at 10% and the remaining $28,075 is taxed at 12%.

- If you have $100,000 of taxable income (again as a single filer), the first $11,925 is taxed at 10%, the next $36,550 at 12% and the remaining $51,525 at 22%.

How Have the Tax Rates Changed Over Time?

Income tax as we know it today did not start out this way. It evolved through a series of laws, reforms and codifications, beginning with the enactment of the 16th Amendment, which gave the government the power to collect taxes based on an individual’s income.

The foundation of modern tax law comes from the Tax Reform Act of 1986. However, the most significant changes in recent history stem from the Tax Cuts and Jobs Act (TCJA), signed into law on December 22, 2017. This legislation reduced individual income tax rates to the brackets we use today, which were later made permanent by the One Big Beautiful Bill Act of 2025.

Here is a brief history of the top marginal tax rates by year:

| Year | Top Marginal Rate |

| 1913 | 7% |

| 1918 | 77% |

| 1942 | 88% |

| 1986 | 50% |

| 2017 | 39.60% |

| 2025 | 37% |

Earning more money and moving into a higher tax bracket does not mean all your income is taxed at that higher rate. It only affects the portion of your income above the bracket threshold. By understanding how marginal tax brackets work, you will be better equipped to make smarter, more confident decisions about your income and financial planning.

As tax rules continue to evolve, having the right guidance can make all the difference. At Weinstein Spira, our team is here to help you navigate these complexities so you can plan confidently and keep more of what you earn. Contact us today if you would like to explore how thoughtful tax planning can benefit you.