Let’s face it, no one looks forward to the auditing process. It is much more fun to go play golf or take care of everyday business challenges, than get ready for your auditor’s visit. Often, people perceive the audit as beginning on Day 1 and, therefore, don’t focus time or energy on it until the auditing team shows up at their office. But a lot can be done in advance to significantly speed up the process with much less frustration along the way—something that both sides want. This post presents some proactive steps that will help your next audit go smoother.

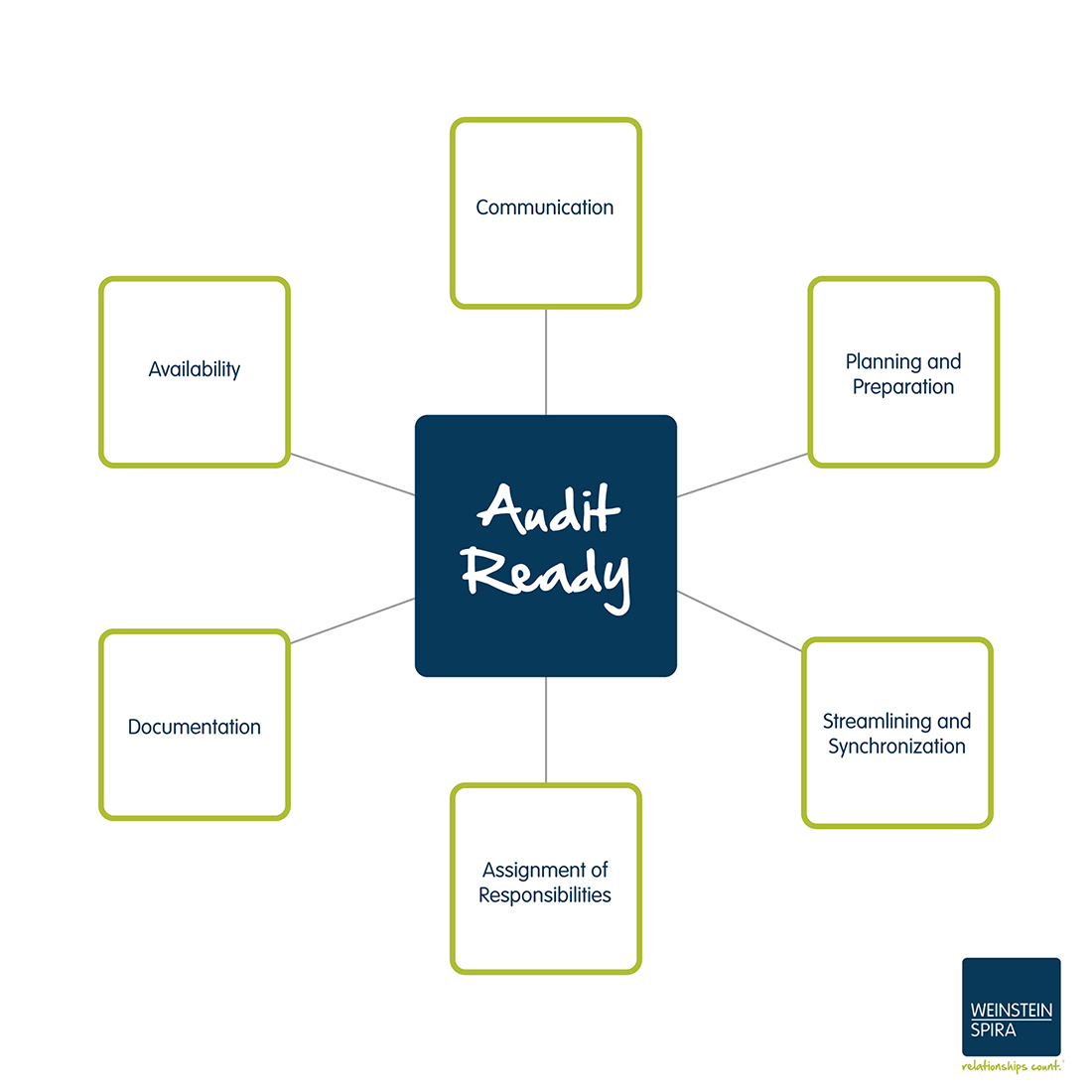

Proactive Steps Before Your Audit Begins

Of course, there is always the chance that something may arise unexpectedly during an audit. But as a general rule, if you follow these simple steps, you will be off to a good start.

- Communicate Throughout The Year

The best audits tend to have open communication that go beyond the audit period. Don’t wait for audit time to figure everything out. It’s smart to ask questions in real time, whenever an accounting issue comes up (i.e. a new type of transaction or an unusual circumstance). If you give your auditor or tax accountant a call to make sure you’re doing things right in the first place, you will avoid having to correct it later on. This is where having a good relationship with your auditor comes into play. - Document Everything!

Make it a habit to keep all documentation associated with your accounting transactions, preferably using a formal document management system or some sort of online file storage mechanism. It will be a lot easier to locate information requested for your audit if such documentation is organized in a repository of folders and subfolders with meaningful labels. Remember, the longer it takes to get the auditors the supporting documents they need, the higher the risk of going over-budget on auditing costs. And if you grant them direct access to relevant electronic document files, they can actually perform the bulk of the work remotely, without tying up valuable office space at your location. - Perform Monthly or Quarterly Reconciliations

Entering accounting data correctly reduces the chance of surprises at the annual audit. That’s why most corporations do what’s called a “monthly close” in order to maintain accurate, balanced accounts ongoingly. It saves time and money to identify, investigate and resolve reconciling items in a timely manner. Waiting until your annual audit to discover and rectify mistakes can not only back things up, it can also compound the error and sometimes turn a small problem into a major loss for your company. - Plan and Prepare

Preparation can seem overwhelming when you first look at the long list of “test items” requested by your auditor. But, when you plan ahead and do a little bit at a time (spending only 30 minutes a day), things will get done in a more relaxed way with less overall stress on everyone—both your team and the auditing team. It is best to send such information to your auditor at least two weeks before the audit is scheduled to start. This data should be as complete as possible. If something is missing, it becomes the focus of the audit and delays all other progress. - Assign Responsibilities

To make sure all of the listed test items are provided, it helps to assign each item to a responsible person on your team with a scheduled due date for delivery. This schedule should allow time for reviewing and correcting any documentation, if needed, prior to the audit. Encourage individuals to ask questions along the way to clarify what the auditor is looking for. Also, take into account that some items will be more time-consuming than others. Then, track the progress of this effort to ensure it is completed on time. - Streamline and Synchronize

It is in both parties’ interest to streamline the process and not duplicate effort. Early planning meetings with your staff are a good way to get everyone in sync and anticipate some audit requirements/explanations (i.e. year-over-year changes) that can be handled as part of year-end financial activities. Also, consider getting on the same page as the audit staff by indexing or tagging your supporting documents to match the numbering scheme of requested test items. - Be Available

The auditor’s fieldwork efficiency depends in large part on your availability and that of your team. Although most of the schedules and workpapers are submitted before the audit officially begins, additional information will be requested, as needed, throughout the course of the audit period. Therefore, you might want to have key accounting personnel plan their vacations and big meetings at times that will not interfere with auditing activities to be able to assist with these ad hoc requests. - Discuss Audit Results

Once the audit is over, hold a meeting with your team participants to evaluate the process and talk about the results. While fresh in your minds, this is the ideal time to acknowledge lessons learned and suggest improvements for the coming year, as well as noting what else can be done in advance of next year’s audit, making each successive audit experience even better.

We Are On The Same Side

Too often, audits make people feel like they are under attack. On the contrary, we want to be in the trenches with you, not on the enemy line. So, let’s work together for the smoothest audit possible, in which you benefit from our advice to guard against accounting for something incorrectly. A good auditor will not only point things out, they will also seize the teaching moment to explain the “why” behind any findings. At the end of the day, you have a lot of control in this interdependent process. Auditors cannot do their job without you and vice versa!