With the arrival of the new year, many of us, me included, aim to bounce back from holiday splurges. I mean, who can resist a 50% off black Friday deal? Nothing feels better than getting your finances in order, especially at the beginning of the year. Budgeting varies for everyone, so finding a method that suits you best is preferred. Personally, I prefer budgeting each paycheck individually and ensuring I have a bit of flexibility. In this blog, I will outline and explain the Budget by Paycheck Method and how it can help you stay on track with your financial goals for the year.

The Benefits of Budgeting

Budgeting prevents you from overspending because you can account for every dollar. It encourages you to stay aligned with your finances. Additionally, it allows you to save for emergencies or upcoming expenses, ensuring a safety net for unforeseen circumstances. By instilling a sense of financial mindfulness, budgeting empowers individuals to make informed financial decisions and cultivates a habit of responsible money management.

The Budget by Paycheck Method Process

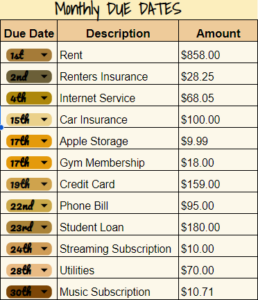

To begin mapping out your budget, write out all the due dates of your expenses. This includes bills, credit cards, loans, and subscription services. An example is shown below.

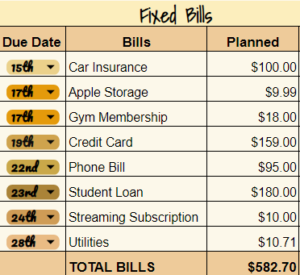

Now that you know what your fixed bills are, you can move onto the next step which is comparing your paycheck to the expenses for that pay period.

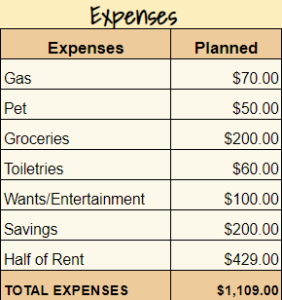

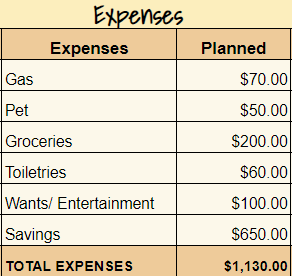

So, let’s say your paychecks land on the 15th and the 30th of each month and for the first paycheck you made $1,700. As you can see in the example, expenses from the 15th through the 28th are to be paid with this paycheck. The total amount of the fixed expenses for this paycheck comes out to $582.70, leaving you with $1,117.30 That seems like a good amount of money left over, but you aren’t done. Now, you need to budget for any other expenses and savings. For example:

These expenses total to $1,109 so in all, you are left with $8.30 after subtracting from $1,117.30. This can be carried over into your next paycheck or used as a buffer for any expenses that may go over what you originally planned. You can also put it toward your savings, whatever you prefer.

I prefer to overestimate my planned expenses to keep me from going over budget. In the expenses, there is an amount added to a savings account and half of rent. The rent expense takes out a big portion of a paycheck, so it helps to put away half of it ahead of time.

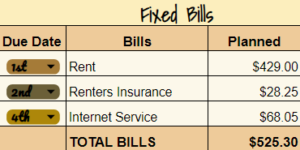

For your second check on the 30th, you will do the same thing. This time, you will be accounting for the bills that are due from the 30th to the 14th (for example, rent, renters’ insurance, and internet service). Remember for rent, you will only be budgeting $429 because you budgeted the other half with the last paycheck. This allows you to live a little more comfortably at the end of the month and potentially put more money toward a savings account or to pay off any outstanding debt.

Additionally, you will use the same amount for the expenses categories for the second paycheck of the month:

Here, your total for expenses is $480. Once you add that to your fixed bills it comes out to $1,005.30. You would then subtract that from your paycheck from the 30th, which would leave you with $694.70. In the example, I included an expense of $650 to go towards savings, thus leaving you with $44.70 that can be carried over into your next paycheck or used as a buffer for any expenses that may go over what you originally planned. It can also be placed into your savings.

The paycheck budgeting method is an easy system to start. It is also an effective way to be intentional about where your money is going. For anyone who might tend to overspend, this is a great way to help you get back on track and closer to your financial goals.

Budgeting can be adjusted to your lifestyle and your own financial situation, so find what works best for you!