Tax reform. Will it happen? Will it be good for our country? What do you know or what are you hoping to see? With the latest reports stating that legislators are aiming to have a tax reform bill on President Trump’s desk by Thanksgiving, our team is paying attention to what may or may not change and how it could affect our clients.

Our work with high-net-worth individuals, family office accounting and through tax and estate planning means that our accountants must stay informed and engaged in individual tax requirements, including tax reform.

While the American public is already speculating what tax reform could mean for them, our team has our sights set on a specific group of Americans and what they think.

With the U.S. Census Bureau reporting that millennials (or those born between 1981 and 1997) now make up the largest percentage of Americans, we were curious to get their take on taxes. We wanted to know what millennials think about their tax responsibilities, in the first place, and how they feel about reform.

With 50 young professionals responding from Houston, Texas, New York, New York, Topeka, Kansas, Washington, D.C. and everywhere in between, their answers might surprise you.

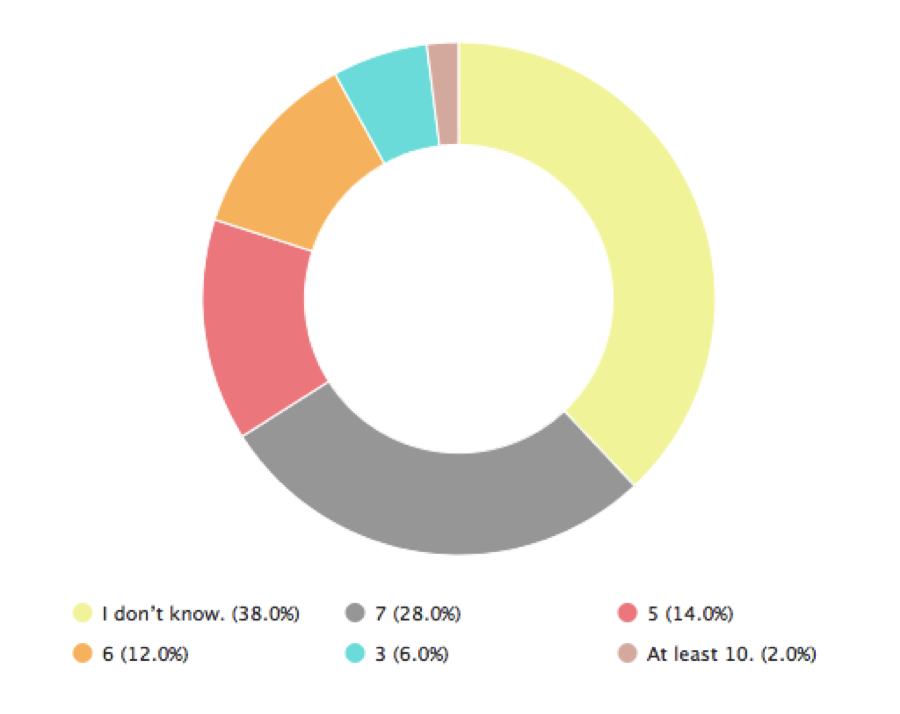

Question 1: How many tax brackets currently exist within the United States?

Answer Options

- I don’t know.

- 3

- 5

- 6

- 7

With President Trump vowing to simplify the United States tax brackets from seven to three, we wanted to know if millennials would understand this change. We were surprised to see that the majority of our 50 respondents did not know how many brackets we have in the US, with the “I don’t know option” receiving 19 votes (38%). 14 of our respondents (28%) were aware that there are seven brackets and the remaining 17 respondents voted with incorrect answers.

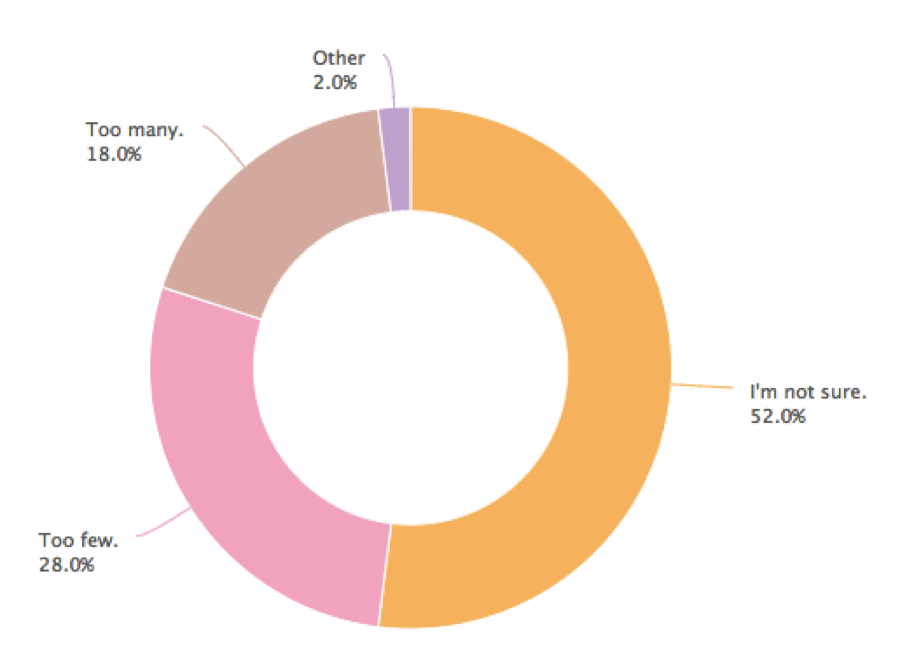

Question 2: Are there too many or too few tax brackets within our country?

Answer Options

- Too many.

- Too few.

- I’m not sure.

- Other.

With so many of our respondents sharing that they didn’t know how many brackets existed or reporting incorrect answers, it’s no wonder that more than half (26 respondents, 52%) responded with “I’m not sure” when we asked how they felt about the number of brackets that exist.

The nine respondents (18%) who shared that there were too many tax brackets may be happy if President Trump’s tax reform plan comes to fruition. The 14 (28%) who noted that there were too few will likely be disappointed.

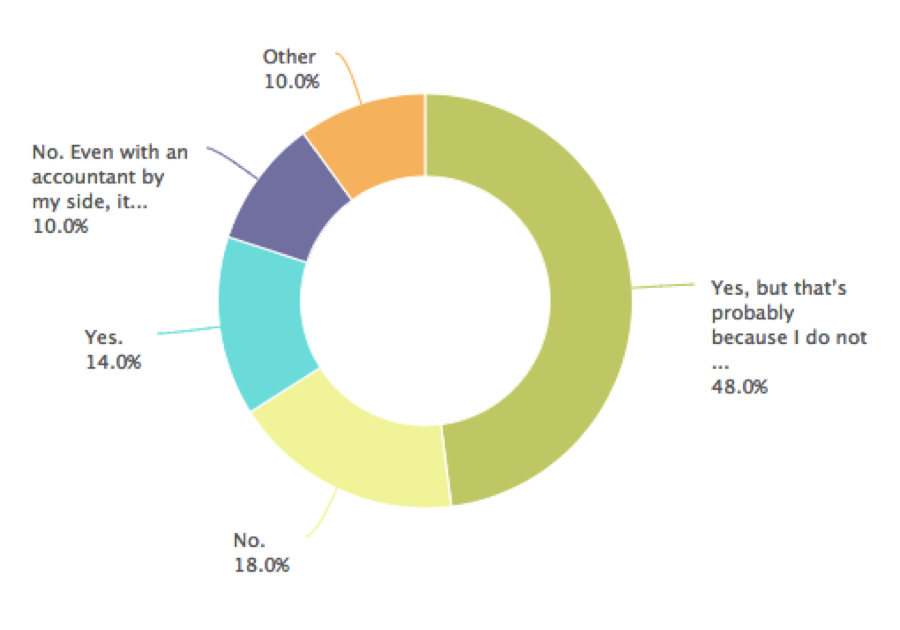

Question 3: The tax filing process is a pretty straightforward one for me.

Answer Options

- Yes.

- Yes, but that’s probably because I do not own personal property, manage investments, have dependents, etc.

- No.

- No. Even with an accountant by my side, it’s too much to keep track of, especially once you start adding in dependents, property taxes, investments, charitable giving and more.

- Other.

31 people (62%), the majority of our millennial respondents, surprised us by answering that they did find the tax filing process to be an easy one. A larger portion of this group (24 people, 48%) answered “yes” with the following caveat: “but it’s probably because I do not own personal property, manage investments, have dependents, etc.”

The other 19 individuals (38%) shared that filing taxes is difficult or opted to choose “other,” which we assumed meant they were somewhere in between having great difficulty and finding the process to be an easy one. Our largest concern for this group is that even those who responded “yes,” will likely find themselves in the “no” category in the coming years when they accrue more wealth and/or financial responsibilities.

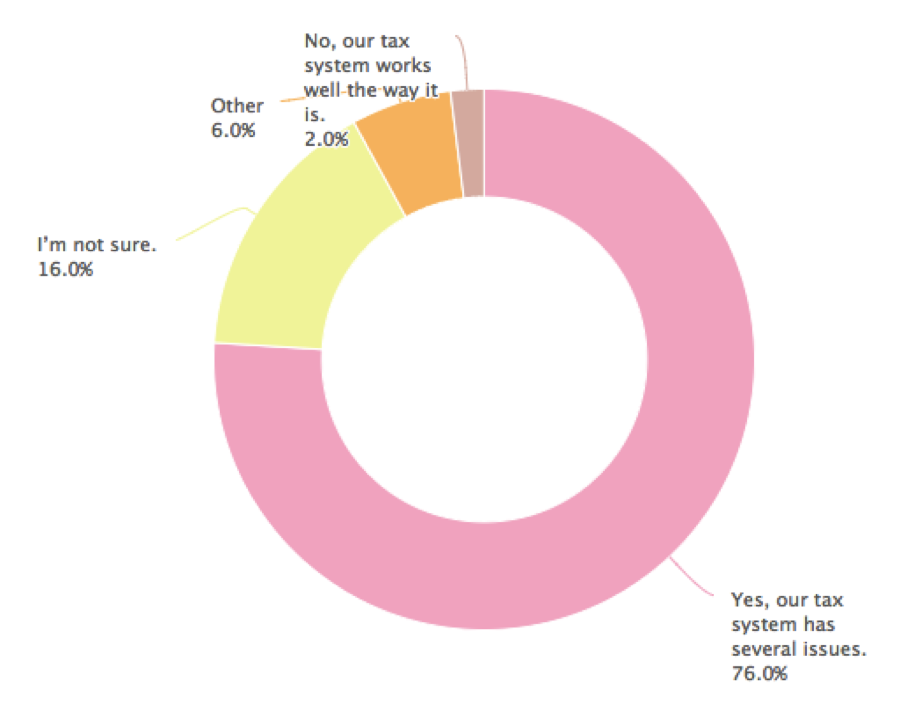

Question 4: I am excited about and/or would like to see the American government develop a tax reform plan.

Answer Options

- No, our tax system works well the way it is.

- Yes, our tax system has several issues.

- I’m not sure.

- Other.

Even though this group doesn’t seem to fully understand the nuances found within our system, a whopping 76% (38 people) responded with “yes, our tax system has several issues.” Perhaps their lack of knowledge is what led them to respond in this way, as it may be hard to trust a system that you don’t fully understand in the first place.

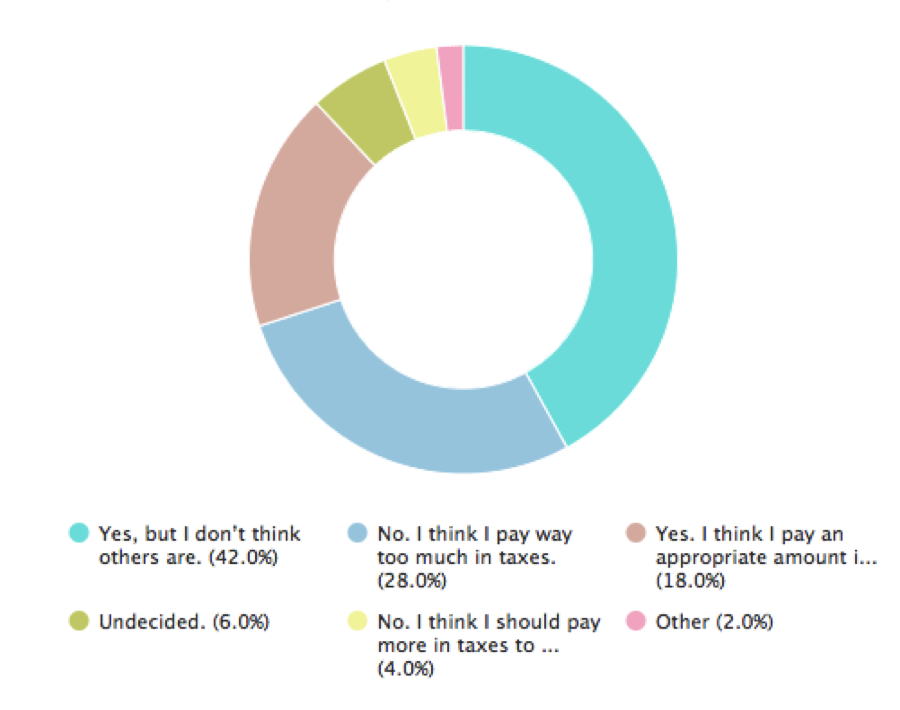

Question 5: Do you think you are taxed fairly by the United States government?

Answer Options

- No. I think I pay way too much in taxes.

- No. I think I should pay more in taxes to help cover the costs of other government programs.

- Yes. I think I pay an appropriate amount in taxes.

- Yes, but I don’t think others are.

- Undecided.

- Other.

Not surprisingly, only 9 responded that (18%) they were taxed fairly. What we did find surprising, however, is that another 42% of respondents (21) did they think were taxed fairly but did not think others in the country are. With 60% of our millennial respondents ultimately agreeing that they were taxed properly, we can’t help but wonder how the larger American millennial population would respond. If the majority of millennials follow the trends we’re seeing, should our President be paying more attention to this group when developing his tax reform plan?

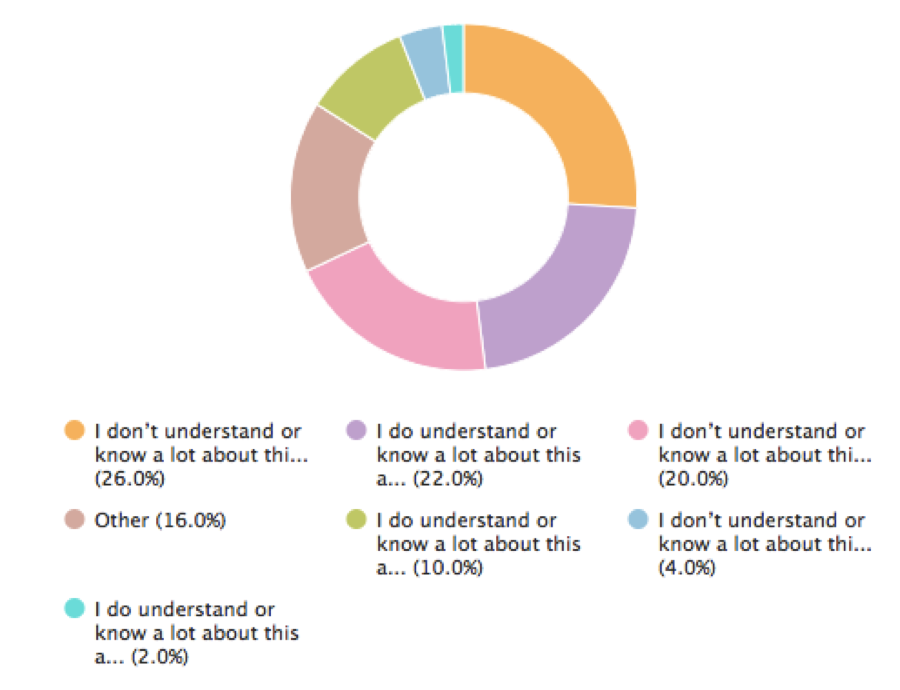

Question 6: I understand what type of taxes businesses or corporations pay and think it is fair.

Answer Options

- I don’t understand or know a lot about this but assume it’s fair.

- I don’t understand or know a lot about this but assume they should be paying more.

- I don’t understand or know a lot about this but assume they should be paying less.

- I do understand or know a lot about this and think it’s fair.

- I do understand or know a lot about this and think they should be paying more.

- I do understand or know a lot about this and think they should be paying less.

- Other.

Answers to this question truly represented a broad range, with nearly half, or 48%, voting (24 people) that they didn’t understand or know a lot about this but thought they should be paying more. Another 10 voters (20%) also responded that they didn’t understand this but the taxation was fair; one more voter said he or she did understand and felt the taxes for businesses are fair. Finally, 7 voters (a combined 14%) may or may not have understood this but felt companies should pay less in taxes. Eight of our respondents chose “other,” perhaps likely felt the issue was a complex one that couldn’t be properly answered in one of the other six options we presented to them.

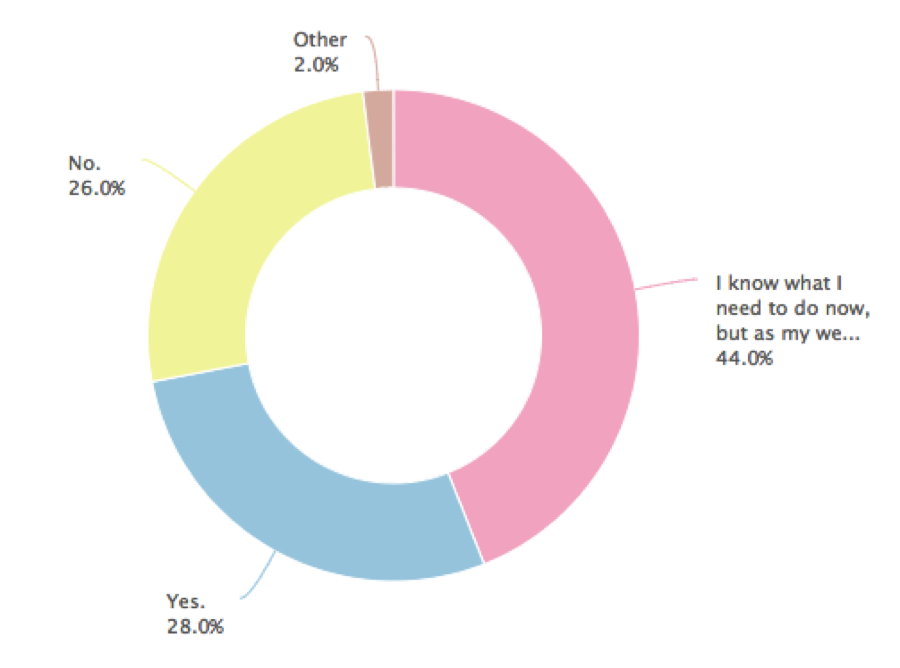

Question 7: I consider myself knowledgeable about the various taxes I am responsible for paying and tax policies and procedures, in general.

Answer Options

- Yes.

- No.

- I know what I need to do now, but as my wealth, family or investments grow, I’ll be totally lost.

- Other.

While 14 (28%) answered a simple “yes” to our question, things weren’t as straightforward for our other 36 respondents. 13 of these voters (26%) answered with a “no” response. As with our question that asked about how easy they found the tax-filing process, a near majority (44%), or 22 voters, shared “I know what I need to do now, but as my wealth, family or investments grow, I’ll be totally lost.”

With tax reform still at the top of our national government’s agenda, Americans aren’t sure what to expect for the future. While our 50 respondents from across the country represent only a small sample of Americans, we’re sure of one thing: millennials are just as divided and confused when it comes to issues of tax reform as the larger public.

Millennial or not, if you have questions surrounding your business, family office or estate tax needs, don’t hesitate to reach out to our teams at Weinstein Spira. As always, we will be staying attuned to the tax reform conversation so we can keep you abreast of how this affects you, in real time.