You’ve likely heard the buzz surrounding President Trump’s tax return since Rachel Maddow revealed a tiny section (just two pages of what was likely thousands) of it on her newscast. Perhaps this was the first time many Americans heard about the alternative minimum tax (or AMT for short), which appeared in these two pages. As tax and accounting professionals, the accountants at Weinstein Spira are incredibly familiar with the AMT, as it is one of the many taxes we keep in mind when preparing our clients’ returns.

So what is the AMT?

The simple answer is that the AMT is a parallel tax that functions along with the regular income tax and that is meant to set limits on certain tax benefits in order to stop wealthy individuals from finding loopholes that keep them from paying taxes altogether. The AMT was developed in 1969 after Treasury Secretary Joseph W. Barr shared with Congress that 155 wealthy taxpayers paid no federal income tax in 1966, whatsoever. Congress’ solution was to develop the alternative minimum tax. While it has evolved since then and now affects many more individuals, still, only a relatively small portion of Americans end up actually paying any AMT.

The long answer is a much more difficult one to explain and understand. Hopefully, these five things will help shine a better light on the intricacies of the AMT that we have come to know and love today.

1. It’s an incredibly nuanced policy.

In order to apply various tax policies for taxpayers and the government, alike, many individuals are required to pay the AMT. However, as CPAs and tax professionals, determining which high-net-worth clientele are subject to the AMT can be an incredibly laborious process that often comes down to asking many questions. Some of the types of questions we ask may include:

- How many business dealings is the client involved in; how are they financed; what is the structure and nature of these businesses?

- Has the client lost money that allows him/her to take deductions? Do they own a lot of property that would result in real estate deductions; are they making various charitable donations; have their businesses incurred net losses?

- What types of investments are they making to be the most tax efficient; municipal bonds, taxable bonds?

- As they are becoming familiar with your documentation, your accountant will likely ask him or herself these questions (and so many more) before honing in on your various tax requirements. And just because some of the items above may be applicable, doesn’t necessarily mean you will ultimately end up paying AMT.

2. It affects a very small group of individuals and their associated businesses.

As a taxpayer, you have likely never heard of the AMT because it doesn’t apply to you, in the first place. Generally, for it to apply, you already must be within the upper-middle class or upper class of income earners. Then, within this subset of individuals, you (or your trust or business) must take certain deductions (losses). Some of these deductions include:

Certain types of accelerated depreciation;

- Tax-exempt interest from private activity bonds;

- Intangible drilling, circulation, research, experimental or mining costs;

- Net operating loss deduction;

- Various property taxes;

…and the list goes on and on.

Long story short – If you aren’t a high-net-worth individual and impacted by the multitude of individual deductions outlined under the AMT rules, the AMT is not relevant to you. While the applicable forms on your tax return related to AMT outline whether you may need to pay the AMT, your accountant will be well aware of this and will advise you on opportunities to potentially alleviate the AMT impact.

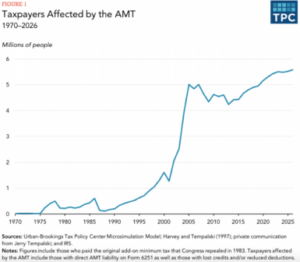

Photo Credit: Tax Policy Center

3. It doesn’t always achieve the desired result (for the individual or the government).

While the AMT was created to ensure wealthy individuals weren’t eliminating all their tax obligation, oftentimes the minimum tax they are now required to pay isn’t meaningful or ends up not applying.

The AMT is calculated after the regular income tax has been calculated. At this point, according to Tax Policy Center, “taxpayers must add a number of AMT ‘preference items’ to their taxable income, subtract an AMT exemption amount, and recalculate their tax using the AMT tax rate structure. AMT liability is the excess, if any, of this amount over the amount of tax owed under the regular income tax rules.”

Tax professionals may find (and often do) that there is no additional amount, whatsoever, over that owed in regular income taxes. When this happens, the AMT is just a redundant step that hasn’t resulted in a higher tax rate.

4. It’s a headache for tax and accounting professionals.

Because of the various nuances involved and the number of deductions, a taxpayer must have to be “bitten by the AMT” in the first place, tax and accounting professionals often find the AMT process to be painstaking.

Likewise, because the AMT is a parallel tax equation that is calculated alongside regular income tax, it makes filing taxes even more laborious and detail-intensive, and, as stated above, sometimes even redundant.

5. It told us very little about President Trump’s larger tax return and financial dealings.

Because President Trump owns so many businesses and has amassed so much wealth, his tax return is quite frankly, massive. With only two out of likely thousands of pages, the fact that he paid AMT tells us almost nothing about his larger return. In fact, the fact that the President paid AMT tells us just that – he paid the alternative minimum tax because he had losses and/or deductions that statutorily were “addbacks” for AMT calculation purposes. For those Americans who are looking for more answers from his return, the AMT can’t tell you anything other than the fact that, because of the AMT, he wasn’t able to deduct all his losses and/or deductions. Likewise, the AMT showcases that while he didn’t pay his full tax rate, he did pay AMT. According to the law, President Trump is entitled to his losses and/or deductions and paying the AMT showcases that he not only had these losses and/or deductions, but that he paid the taxes associated with them.

As you can see, the AMT, while intended to ensure all individuals pay taxes as dictated by the law, is extremely complicated. Always consult your team of tax and accounting professionals with questions as you have them and arm them with the information they need to file your taxes properly.